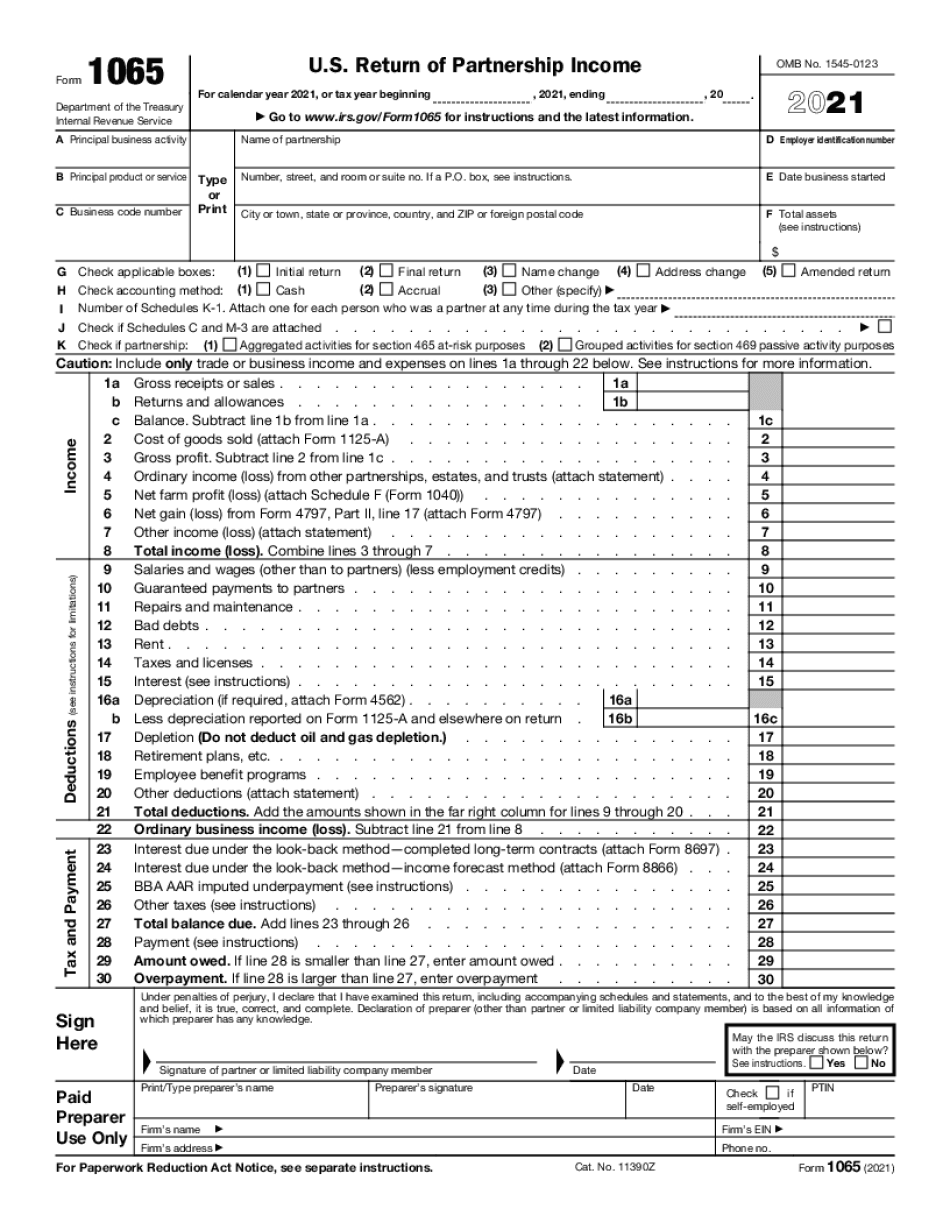

Hey everyone, I'm Bradford with The Penny Pinterest, a personal finance channel. First, make sure you hit that like button so we know to make more videos like it. Today, I'm going to walk you through how to fill out IRS Form 1065, the informational tax return you're required to file if you have a partnership. When you fill out your form, please make sure you're referencing the 1065 instructions that are included in the description down below. Quick caveat before we begin, if you have a complicated tax situation, please consider consulting with a tax professional to make sure you file your forms correctly. It's not worth trying to save a couple of hundred bucks now, only to be hit by heavy fines by the IRS. Now, let's jump into the form. Alright, so now that we're in the form 1065, the first three items you're going to be concerned about are items A, B, and C. Item A deals with your principal business activity, and item B asks for its associated code number. If you have any questions regarding this, refer to the 1065 instructions provided below. Next, you'll need to provide the name and location of your business. For this example, since we're mirroring a business similar to the YouTube business that Chase and I have, let's call it the YouTube Side Hustle located at 123 Main Street in Small Town, South Carolina. Moving on, item D asks for your employer identification number, which you will receive from the IRS when you first establish your business. Item E requires the date that the business started. For this example, let's say it's January 1st, 2021. Item F is about total assets, but most people do not have to worry about this. We will address whether or not you need to fill that out...

Award-winning PDF software

How to prepare Form 1065

About Form 1065

Form 1065 is a tax return form used by partnerships in the United States to report their income, deductions, gains, losses, and other tax-related information. Partnerships are business entities wherein two or more individuals or entities come together to carry on a trade or business. Partnerships are generally not subject to income tax at the entity level, and instead, the income or losses "pass through" to the partners who are responsible for reporting the partnership's income on their individual tax returns. Form 1065 is used to calculate the partnership's taxable income, allocate it among the partners, and provide a detailed breakdown of the partnership's financial activities. Therefore, any partnership, including general partnerships, limited partnerships, limited liability partnerships (LLPs), and certain limited liability companies (LLCs), need to file Form 1065 each year if they meet the filing requirements set by the Internal Revenue Service (IRS). Even if the partnership did not generate any income during the tax year, it is still required to file Form 1065 to report any deductions or losses.

Get Form 1065 and simplify your day-to-day document management

- Locate Form 1065 and begin editing it by clicking Get Form.

- Begin completing your form and include the details it requires.

- Benefit from our extended editing toolset that lets you add notes and make comments, if needed.

- Take a look at form and double-check if the details you filled in is right.

- Swiftly fix any error you have when changing your form or go back to the previous version of the file.

- eSign your form easily by drawing, typing, or capturing a photo of the signature.

- Save alterations by clicking Done and after that download or send out your form.

- Send your form by email, link-to-fill, fax, or print it.

- Select Notarize to do this task on the form on the internet using our eNotary, if needed.

- Securely store your approved file on your PC.

Editing Form 1065 is an easy and user-friendly process that requires no previous training. Find everything that you need in a single editor without constantly switching between different platforms. Locate more forms, fill out and preserve them in the file format of your choice, and improve your document management within a click. Before submitting or sending your form, double-check details you filled in and swiftly fix mistakes if needed. In case you have any queries, contact our Customer Support Team to help you out.

Video instructions and help with filling out and completing Form 1065